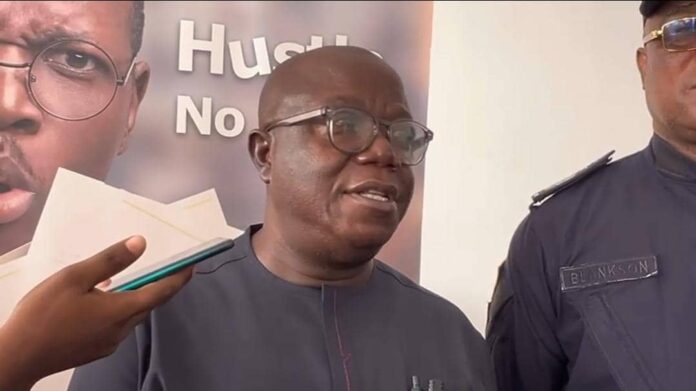

Ghanaians who don’t reveal their sources of taxable income abroad risk being penalized by the Ghana Revenue Authority, according to Edward Gyamerah, Commissioner of the Domestic Tax Revenue Division.

This announcement was made during a management retreat in Takoradi in the Western region and is part of the Authority’s strategy to increase revenue generation in the country. The voluntary disclosure program will allow residents with income abroad to disclose their earnings without payment of penalty.

After amending the Income Tax Act 896 in 2016, Ghana made the shift from the source of jurisdiction to global.

This means that the Ghana Revenue Authority now has the ability to obtain information on resident Ghanaians with accounts in 145 other countries, allowing them to track down those who have undisclosed income. Sanctions for non-disclosure include administrative and judicial measures to enforce the collection of the tax.

The theme for the retreat was “Tax, Transparency, and Certainty, the GRA way”. This initiative reflects the GRA’s commitment to ensuring that taxpayers comply with the tax laws and contribute their fair share to national development.