Commercial banks in Ghana, in collaboration with the Bank of Ghana, are implementing stricter measures to prevent individuals and businesses with poor credit history from accessing loans.

These measures involve utilizing the Credit Reference Bureau and other initiatives set forth by the central bank to ensure that no loan is approved without a thorough review of the borrower’s credit history.

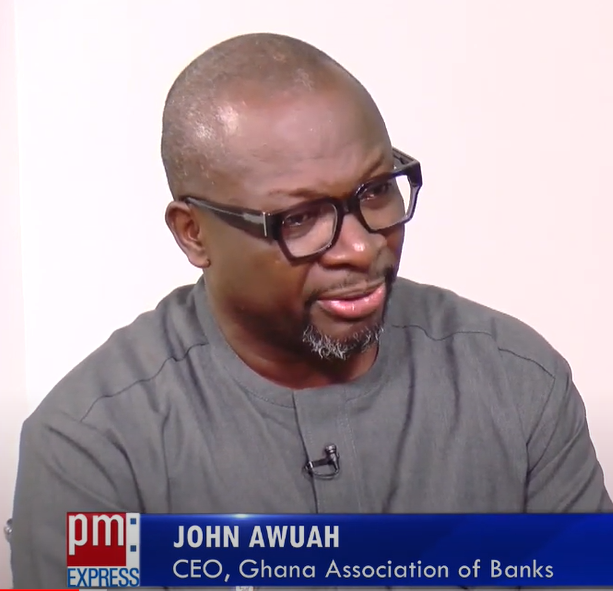

According to John Awuah, the Chief Executive of the Ghana Association of Banks, defaulting borrowers will be automatically blacklisted, emphasizing the importance of assessing creditworthiness before granting loans.

Additionally, one of the new measures includes the refusal to provide loans to individuals who cannot meet their rental obligations. Awuah highlighted the expansion of the credit reporting portal to encompass other aspects to evaluate the financial responsibilities of borrowers in various areas.

He dismissed claims that the high Non-Performing Loans in the banking sector are attributed to ambitious credit targets set for credit officers, stating that loan approval committees prioritize the quality of loans over meeting targets.

Recent data from the Bank of Ghana indicates that Non-Performing Loans are around 20%, signifying a substantial risk where approximately gh¢20 out of every gh¢100 loaned may not be repaid. The Governor of the Bank of Ghana, Dr. Ernest Addison, noted that the increase in bad credit in 2023 is linked to the general challenges faced by borrowers in repaying loans, reflecting the broader macroeconomic difficulties experienced in 2022.

In efforts to recover bad loans, significant progress has been made in collaboration with the judiciary. Prominent figures such as Chief Justice Gertrude Torkornoo have committed to supporting these recovery efforts by working with judges to enhance their understanding of acts and regulations that can facilitate loan recovery. However, challenges persist, with the process of winning a case taking an average of 4 to 5 years, making it arduous for banks to enforce rulings.

Furthermore, Awuah attributed the banking sector’s challenges to the current economic conditions, noting that numerous businesses are facing difficulties meeting their financial obligations to banks.

The Bank of Ghana recently revised its regulations on credit extension, emphasizing the importance of ensuring that borrowers fully comprehend the terms and conditions of loan agreements to validate the binding nature of the contract. Despite these efforts, borrowers commonly overlook the terms and hastily sign loan agreements without a complete understanding of the conditions.